when does capital gains tax increase

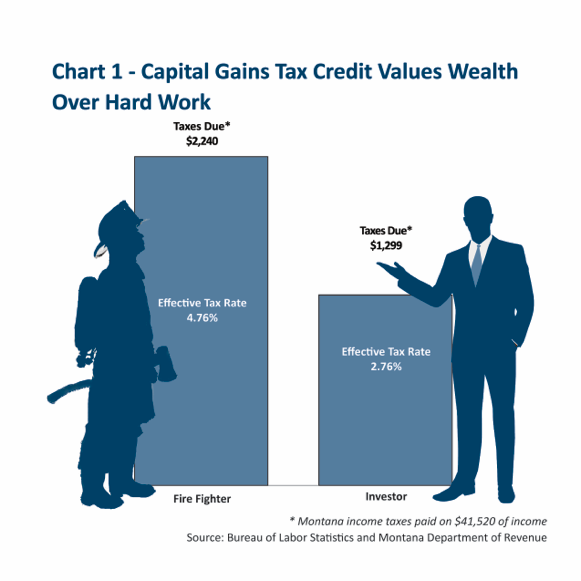

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. The higher your income the higher your rate.

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Its the gain you make thats taxed not the amount of.

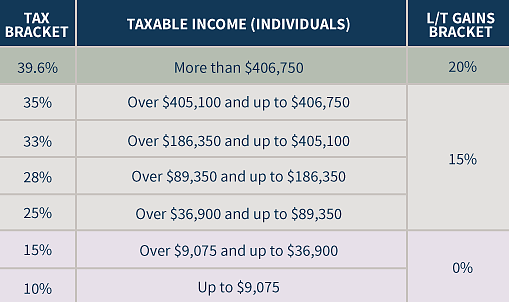

. Capital gains taxes on assets held for a year or less correspond to ordinary. In 1978 Congress eliminated. Just like income tax youll pay a tiered tax rate on your capital gains.

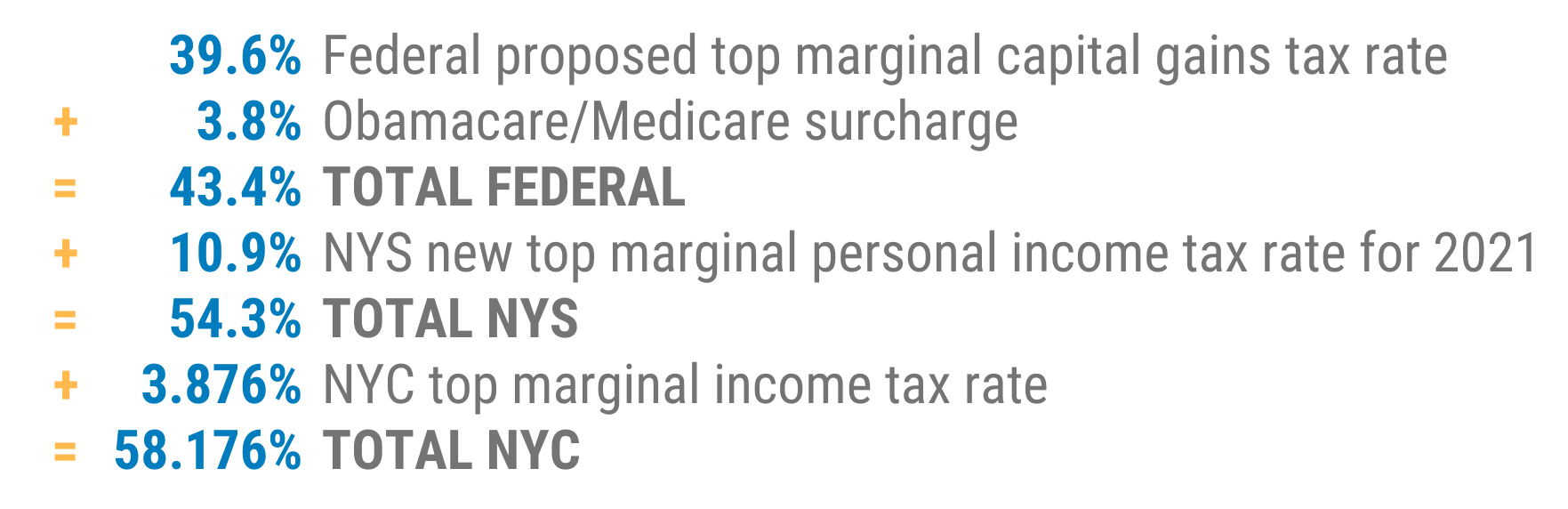

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. For example a single person with a total short-term capital gain of. Rather gains are taxed in the year an asset is sold regardless of when the gains accrued.

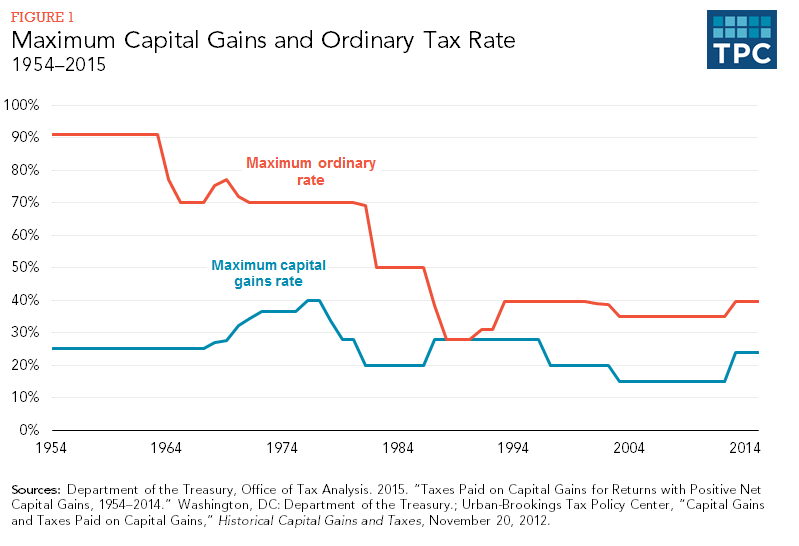

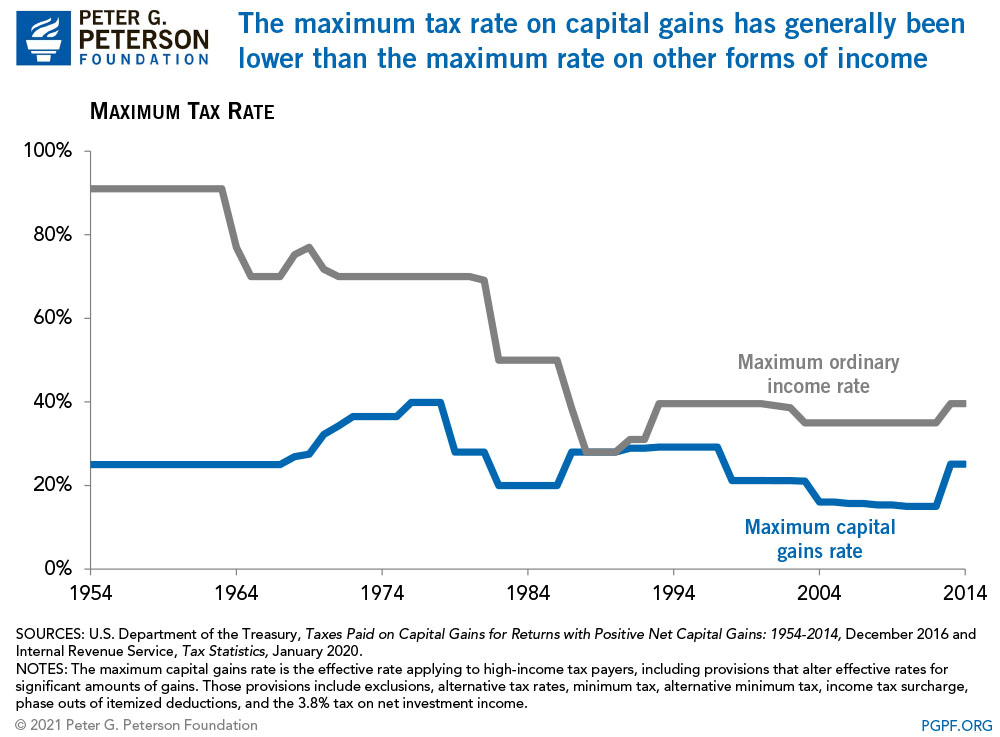

From 1954 to 1967 the maximum capital gains tax rate was 25. Capital gains tax rates are the same in 2022 as they were in 2021. It would increase the tax.

Those with incomes above 517200 will find themselves getting hit. 0 15 or 20 depending on your income. Understanding Capital Gains and the Biden Tax Plan.

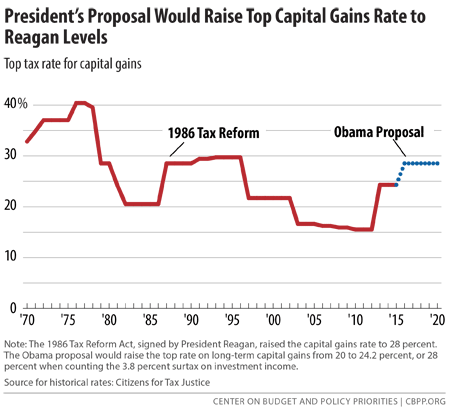

Yet for those with capital gains in lower. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. However married couples who earn between 83350 and 517200 will have a capital gains rate of 15.

To summarize many of the OTS proposals did not pass however we can see there are some increases in tax for capital gains. The federal income tax does not tax all capital gains. Long-Term Capital Gains Taxes.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. At the state level income taxes on capital gains vary from 0 percent. The capital gains tax is based on that profit.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. 2022 federal capital gains tax rates.

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

How Could Changing Capital Gains Taxes Raise More Revenue

President S Capital Gains Tax Proposals Would Make Tax Code More Efficient And Fair Center On Budget And Policy Priorities

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Biden To Propose Almost Doubling Capital Gains Tax Rate For Wealthy Individuals Bloomberg Reuters

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Capital Gains Tax Hike No Gains No Fairness Hoover Institution Capital Gains Tax Hike No Gains No Fairness

Capital Gains Full Report Tax Policy Center

Do The Math Cap Gains Tax Hike For New Yorkers Dsj Cpa

Capital Gains And Tax Reform Committee For A Responsible Federal Budget

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World